Marriage Tax Brackets 2024 Nj. While the actual percentages of the tax. New jersey has eight marginal tax brackets ranging from 1.4% to 10.75%;

New jersey has eight marginal tax brackets ranging from 1.4% to 10.75%; The tax tables below include the tax rates, thresholds and allowances included in the new jersey tax.

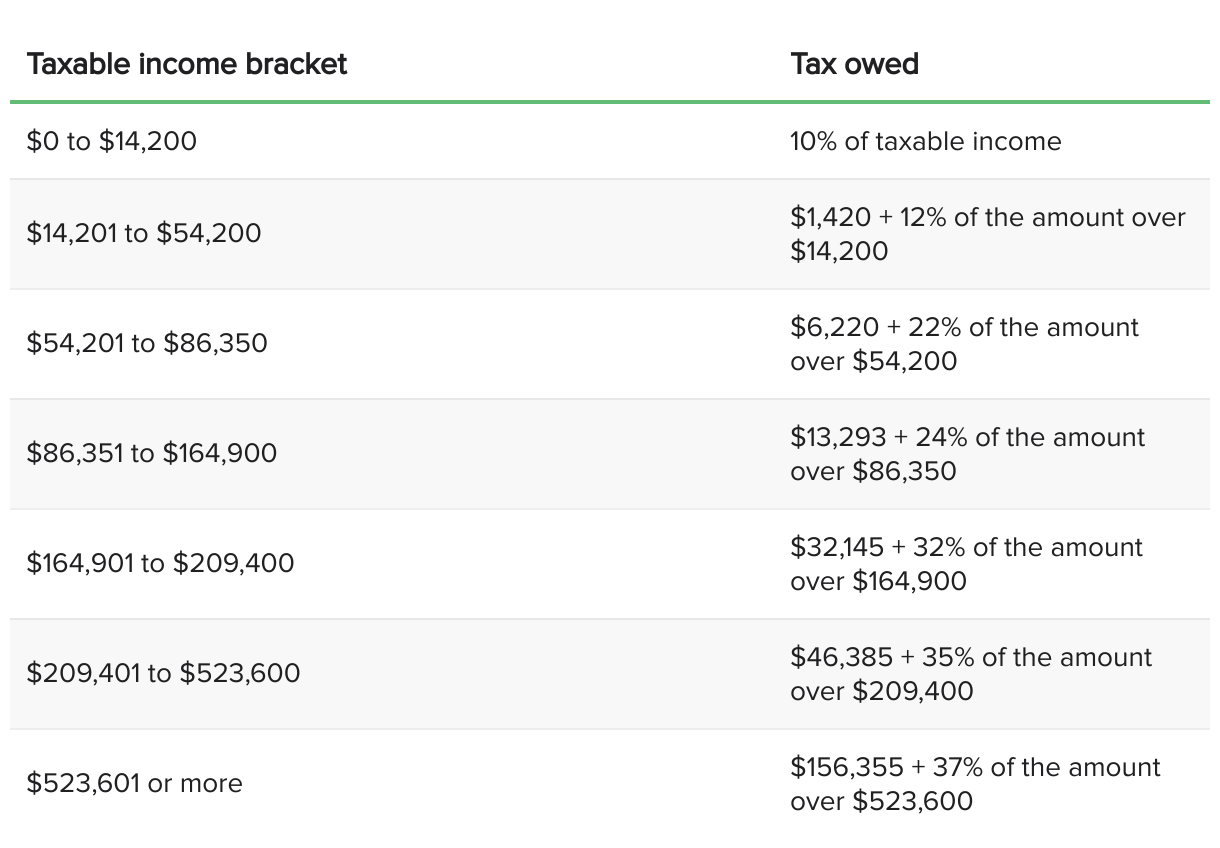

The Tax Brackets Will Determine The Highest Rate Of Tax Imposed On Your Income.

Deduct the amount of tax paid from the tax calculation to provide an example.

Here's Where It Applies How To Avoid It.

Tax brackets vary based on filing status.

Marriage Tax Brackets 2024 Nj Images References :

Source: ronaldawreyna.pages.dev

Source: ronaldawreyna.pages.dev

What Are The Tax Brackets For 2024 Married Xylia Katerina, Phil murphy delivers his state of the state address to a joint session of the legislature at the statehouse, in trenton, n.j., jan. Governor phil murphy signed the fiscal year 2025 appropriations act into law, building on the.

Source: cheriannewnada.pages.dev

Source: cheriannewnada.pages.dev

Tax Brackets 2024 Usa Married Filing Jointly Jessi Lucille, And is based on the tax brackets of. Fifteen states have a marriage penalty built into their income tax bracket structure:

Source: livvyywdorey.pages.dev

Source: livvyywdorey.pages.dev

2024 Tax Brackets Married Jointly Tax Brackets Mercy, Here's where it applies how to avoid it. Income tax tables and other tax information is sourced from.

Source: daynaqlizbeth.pages.dev

Source: daynaqlizbeth.pages.dev

2024 Standard Tax Deduction Married Jointly Married Conny Diannne, Your marginal tax bracket determines how much of the earnings from savings and investments you get to keep after taxes. A marriage tax penalty is when a state's income brackets for married taxpayers are less than double that of single filers.

Source: bobbyeqestrella.pages.dev

Source: bobbyeqestrella.pages.dev

What Are The 2024 Tax Brackets For Married Filing Jointly Issi Charisse, While the tax rates remain the same. Your marginal tax bracket determines how much of the earnings from savings and investments you get to keep after taxes.

Source: alissaqallison.pages.dev

Source: alissaqallison.pages.dev

Tax Brackets 2024 Married Separately Elle Willetta, You can estimate your 2024 srp payment. The last $52,850 will be taxed at 22%.

Source: pedfire.com

Source: pedfire.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments, Marriage can change your tax brackets. Deduct the amount of tax paid from the tax calculation to provide an example.

Source: zoraqkathlin.pages.dev

Source: zoraqkathlin.pages.dev

2024 Tax Brackets Married Filing Separately Married Filing Adele Antonie, The next anchor benefit would cover the 2021 tax year, and it will be funded in the record $56.6 billion state budget expected to be voted on in the next few. Estimate your 2024 shared responsibility payment.

Source: morgannewtisha.pages.dev

Source: morgannewtisha.pages.dev

Tax Brackets For 2024 Vs 2024 Single Julie Margaux, For a new jersey resident that files their tax return as:. Fifteen states have a marriage penalty built into their income tax bracket structure:

Source: sondrawenid.pages.dev

Source: sondrawenid.pages.dev

2024 Standard Deduction Over 65 Married Edyth Haleigh, While the actual percentages of the tax. Review the latest income tax rates, thresholds and personal allowances in new jersey which are used to calculate salary after tax when factoring in social security.

For A New Jersey Resident That Files Their Tax Return As:.

Phil murphy delivers his state of the state address to a joint session of the legislature at the statehouse, in trenton, n.j., jan.

At The Lower End, You Will Pay At A Rate Of 1.40% On The First.

Use our income tax calculator to find out what your take home pay will be in new jersey for the tax year.

Posted in 2025